All Risks - Car Insurance Broker Ontario

Car Insurance Broker Ontario

Getting car insurance in Ontario doesn’t have to be difficult! At All-Risks Insurance Brokers, we take the time to explain your options and how you can save money. If you are looking for a car insurance quote for your everyday car or even for that special ‘hobby car’ in the garage, making sure that your coverage is current, accurate, and affordable is our goal.

Stop by any of our offices in Ontario (see a complete list of our locations here) to speak with one of our brokers- we are always happy to provide you with a free online car insurance quote and consultation. We want to ensure that you get a great rate with proper coverage- before you need it!

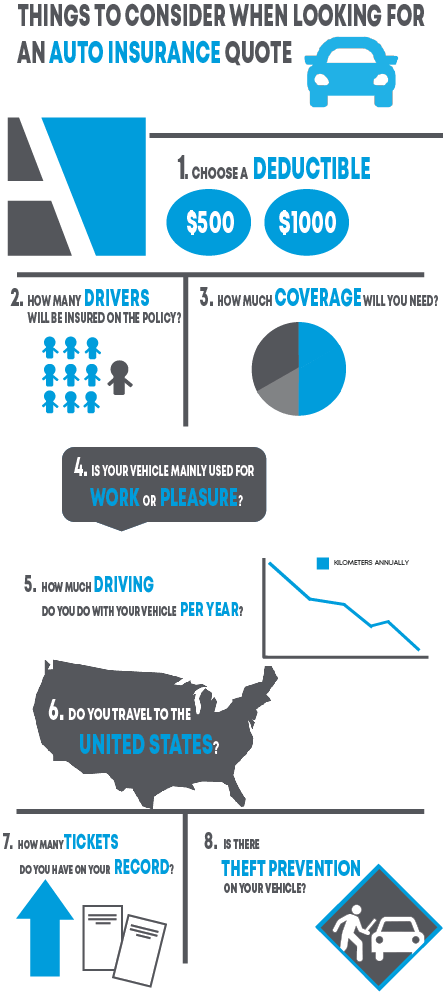

The following are some of the main topics to be discussed during your car insurance broker Ontario quote consultation. As we delve deeper into your policies and coverage, you will gain a greater understanding as to what best meets your needs or your life situations.

Topics to be discussed during your car insurance

- Deductible. The deductible you choose can have an impact on your insurance rates and also affects how certain types of claims will impact you financially.

- How many drivers will be insured on the policy? What are their ages and driving histories? Younger drivers tend to have higher rates. Minor and major convictions can have an impact on your car insurance rates for anywhere from 5-10 years.

- What coverage is needed for your vehicle? Older vehicles may require less coverage while newer vehicles will likely warrant more extensive coverage. Also, sports cars and vehicles with features such as advanced stereo equipment or body modifications can increase your rates.

- Will the primary use of the vehicle be for work or pleasure?

- How much driving do you do with your vehicle per year?

- Do you travel to The United States with your car?

- How many traffic infractions and claims do you have (regardless of fault, we still need to know about them)?

- Is there a theft-deterrent system built into your vehicle? In some instances, lower premiums can be offered if anti-theft systems are installed.

Our recommendation to each of our clients is to Ask Questions! We work for you, which is why we shop our insurance companies to find you the best rates for the coverage you need. We look forward to speaking with you.